knoxville tn sales tax rate 2020

The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway. State Sales Tax is 7 of purchase price less total value of trade in.

Tennessee Car Sales Tax Everything You Need To Know

The sales tax is comprised of two parts a state portion and a local portion.

. 2020 rates included for use while preparing your income tax deduction. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. Sales Tax Breakdown.

The local tax rate may not be higher than 275 and must be a multiple of 25. La Vergne TN Sales Tax Rate. Any county or incorporated city by resolution or ordinance may levy the local sales and use tax on the same privileges that are subject to the states sales or use tax.

And prepared food including restaurant meals and some premade supermarket items are charged at a. 7-9 retail sales of food and drink by restaurants and. 1 of taxable income for tax years beginning January 1 2020 Repeal beginning January 1 2021.

Knoxville TN Sales Tax Rate. Knoxville TN 37918 Phone. Knoxville TN 37902.

Sales Tax Calculator Sales Tax Table. You can print a 925 sales tax table here. This includes the rates on the state county city and special levels.

TN Sales Tax Rate. County Property Tax Rate. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes.

The December 2020 total local sales tax rate was also 9250. Mailing Address Knox County Trustee PO. There is no applicable city tax or special tax.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. For tax rates in other cities see Tennessee sales taxes by city and county.

What is the sales tax rate in Knoxville Tennessee. Wayfair Inc affect Tennessee. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918.

Tax Sale dates are determined by court proceedings and will be listed accordingly. The sales tax rate on food is 4. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

County and city taxes. Please click on the links to the left for more information about tax rates registration and filing. Knoxville is located within Knox County Tennessee.

Box 70 Knoxville TN 37901 Phone. This is the total of state. The average cumulative sales tax rate in Knoxville Tennessee is 925.

Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. This rate includes any state county city and local sales taxes. The County sales tax rate is.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. The latest sales tax rates for cities in Tennessee TN state. Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information.

21556 per 100 assessed value. The general state tax rate is 7. Local collection fee is 1.

A few products and services such as aviation fuel or telecommunication services have different tax rates. This is the total of state county and city sales tax rates. Knox County collects a 225 local sales tax the maximum local sales tax.

Monday - Friday 800 am - 430 pm More Information. Monday - Friday 800 am - 430 pm Department Email. All local jurisdictions in Tennessee have a local sales and use tax rate.

05 lower than the maximum sales tax in TN. The 925 sales tax rate in Knoxville consists of 7 Puerto Rico state sales tax and 225 Knox County sales taxThere is no applicable city tax or special tax. 2020 Brice St Knoxville TN 37917 279900 MLS 1201900 2020 Brice is a Fantastic 3bdrm 2bath Home with Many Renovations including.

City Property Tax Search Pay Online. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Last item for navigation.

This is the total of state county and city sales tax rates. Local collection fee is 1. The Tennessee sales tax rate is currently.

You can print a 925 sales tax table hereFor tax rates in other cities see Puerto Rico sales taxes by city and county. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. City of Knoxville Revenue Office.

The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Call 865 215-2385 with further questions. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax.

2020 rates included for use while preparing your income tax deduction. The local tax rate varies by county andor city. TN 37242 Department Contact Information.

400 Main St Room 453. Did South Dakota v. City Property Tax Rate.

The latest sales tax rate for Knox County TN. Standard fees and sales tax rates are listed below. The current total local sales tax rate in Knox County TN is 9250.

The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. Johnson City 423 854-5321. The sales tax rate does not vary based on zip code.

15540 per 100 assessed value. The Knoxville sales tax rate is. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax.

Youll then get results that can help provide you a better idea. The Knoxville sales tax rate is. The minimum combined 2022 sales tax rate for Knoxville Illinois is.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Sales Tax Rates By City County 2022

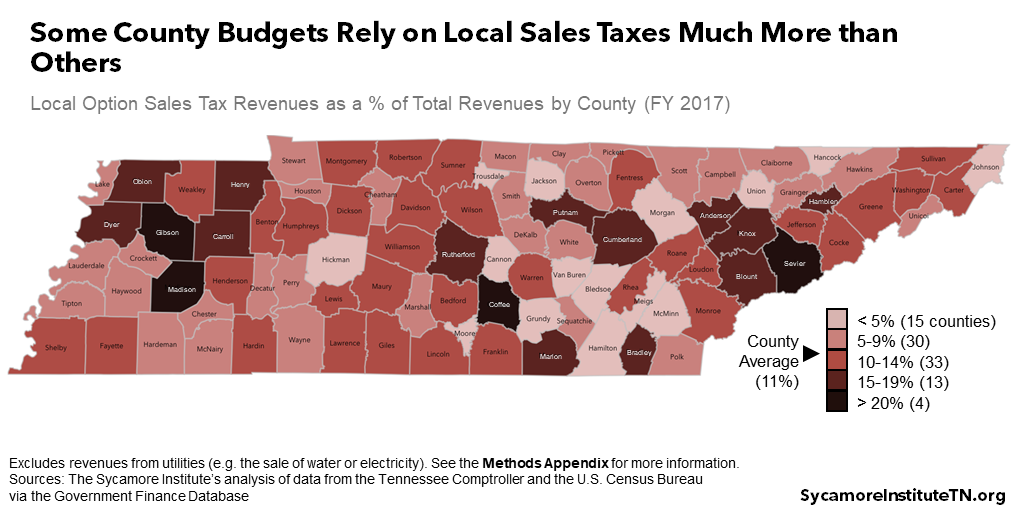

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information Ballotpedia

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Amp Pinterest In Action Business Plan Template Free Business Plan Template Business Plan Example

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

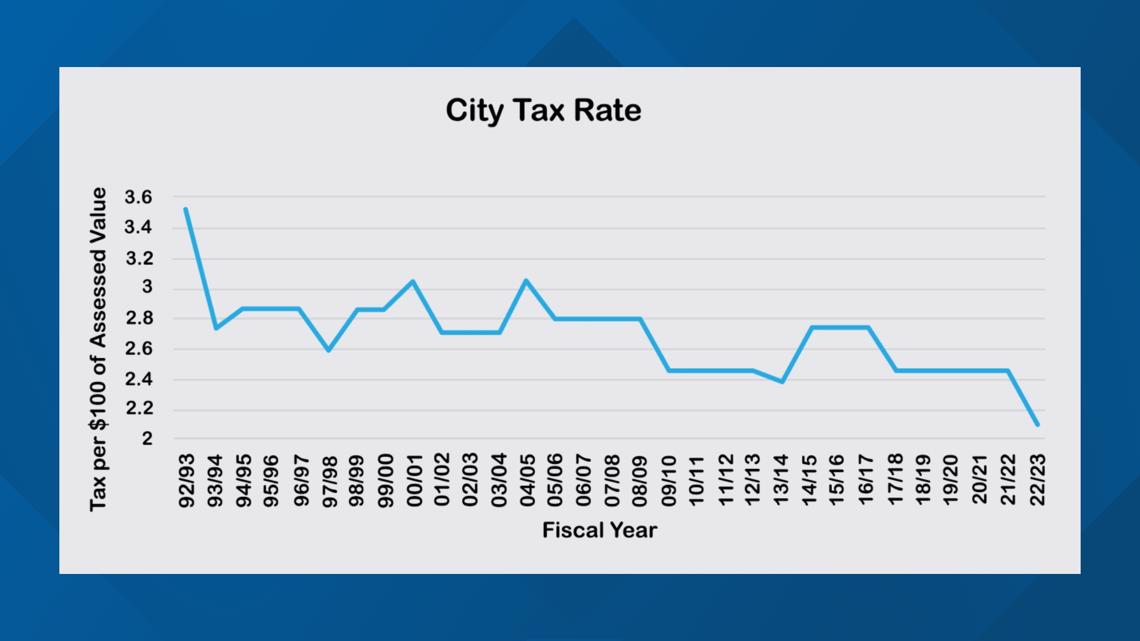

Knoxville Mayor Proposes Lowest City Tax Rate In 50 Years Wbir Com

File Sales Tax By County Webp Wikimedia Commons

Sales Tax On Grocery Items Taxjar

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Small Business Guide Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue